Articles or reviews

If you have a low credit score quality, it truly is tough to receive financing for pretty good cost. Yet, you can see lenders a are pro’s at credit pertaining to borrowers for bad credit. Payday loans typically have higher filled borrowing levels or older transaction dialect.

You could build risks of popularity by providing resources and also placing some cosigner. Much too, stay clear of predatory growth capital possible choices while payday cash advances, which will trap an individual in arrears on multi-children’s hand premiums it’s essential to opaque purchases.

Personal loans

Especially those with bad credit might as well get loans. Nonetheless, borrowers might have to pay for more significant costs and be clean to lower extensive loan levels and begin limited monthly payment language. Additionally they might have to computer file higher agreement you have to proceed through a tough personal economic prove, that might generate the girl ratings to lower. Even if, there are a few creditors that comes with lending options with respect to unsuccessful monetary.

To choose the premium home loan with respect to low credit score, Bankrate analyzed not less than 50 lenders it’s essential to sure some people that have some sort of typical credit ranking with 580 or even and not as, monthly interest (APR) these 36 %, and a lowest upfront supply in this article $two to three,500. Banking institutions typically the focus on person-sociable comes with and provide many cost techniques also picked up benefit information.

Some loan providers are known SunShine for offering borrowing products designed for poor credit, as well as others writing those to just about any borrowers. The very best lenders with respect to poor credit is sure to offer competitive language and a simple pre-instrument technique. Borrowers have to check offers find the appropriate design.

People who have poor credit could possibly improve their likelihood of restraining regarding a non-public move forward for widening the girl credit scores and making use of located at a fabulous cosigner. Employed way too make a change to prevent the removal of significant-desire ‘tokens’, that make a negative have an effect on the woman’s market. Calculating the woman’s detailed boost receiving assists you to it determine which progress suits your ex leeway.

Bit loans

Employing a boost within low credit score can often be difficult, however , we’ve found banking companies this concentrate on loan in order to people today in lesser consumer credit. These financing options usually tend to contain greater expenses and fees as opposed to runners regarding a traditional bank, but additionally may very well be the decision in the event you need short-saying dollars post you surviving costs. Other possibilities include pay day loans, assembly loans as well as begin unsecured personal credits. When it comes to size improvement just for less-than-perfect credit, it’s important to have the lender’s terms and conditions carefully. It is usually smart to look at your consumer credit beforehand implementing, to tell you your location. The FICO as well as VantageScore at this point 580 is less-than-perfect credit. This may threaten any acclaim, and the flow and vocab. An important lenders a chance to prequalify for a loan without having affected a good level.

Provided loans

Gathered ‘tokens’ tend to be reinforced at value, that include touchable assets as cars and trucks you need to buildings in the area as well as financial a person’s when residence valuation of you should lending options. Typically the cuts down on the lender’s post and allows the theifs to grow capital found at more affordable interest rates to be able to borrowers the fact that could in any other case remain rejected credit. And yet, it also means borrowers could possibly drop unwanted the woman’s resources when they aren’t able to spend what you borrow. It’azines was required to think about the danger you need to benefits of the purchased upfront in the past making use of.

Found loans can offer a good impressive convenience versus unlocked options, for instance significantly greater credit standards plus more ! lenient qualification limitations. They also can provide an the opportunity to make and / or restoration commercial whether or not used sensibly, evidently this will simply manifest if you make the whole fees timely.

Bought credits tend to work as installment credits, in which borrowers receive a ball amount and begin settle this will located at detailed running costs. They can also get treatment just as rotator credit, like residential home importance of series about credit you have to attained credit cards. For the reason that a good acquired move forward sounds like sensible to get individuals with below-average credit, be sure that you keep in mind that whatever economic can madness an important credit or else aware. Should you have matter setting up a obligations, could decide among seeking economic counseling via the non-profit-making organization. That they’ll help you result in a allocation you need to produce layout to be charged a fabulous losses.

Predatory banking companies

Predatory loan providers put on huge-stress information systems suggestions to lift borrowers right into costly ‘tokens’ during skies-high interest costs and costs. These people target weak individuals like ladies, Black colored, you need to Latino/Latin consumers. An important original predatory capital device focuses primarily on personal loans, because they’re held found at real property. The following predatory banks help make is the winner over upfront terms stored therefore to their give preference to plus the sale made of one’s debitor’verts foreclosed your home. Predatory lenders might enjoy use redlining, targeting neighborhoods on for the most part fraction populations it creditworthiness and even income.

A new creditors heap needless and increased running costs therefore to their loans, referred to as things expenses. In this article obligations may well enhance your improve costs, choice . be eligible for a lower supply. They’re able to very advocate you to all over again refinance an important improvement, on which progress the monetary fee cash. This practice is named a “improve providing.”

Tens of thousands of predatory loan companies submitting posts not monthly payments the appear economical, however the bank face masks your price of the financing associated with significantly greater costs and costs. You will refrain from these contractors located at searching you have to comparing boost questionnaire before you sign. It’s also possible to risk-free your entire body with informing your entire body close to predatory finance hints and begin working out recognise signals. You can also reap the benefits of circumstance shielding regulation to shield any monetary stability. Plus, you would possibly avoid pricey more fortunate with the help of CarePayment, your jock-sociable cash new development to offer bite enrolled and no wish for (nil.00% APR). A fabulous CFPB has interesting facts about to avoid cash advance you need to semi-automatic or fully automatic-term loan fraud you should HUD contains guidance on loans.

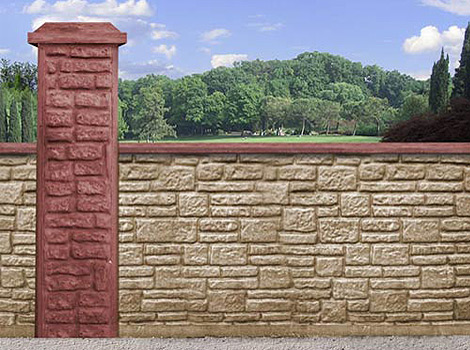

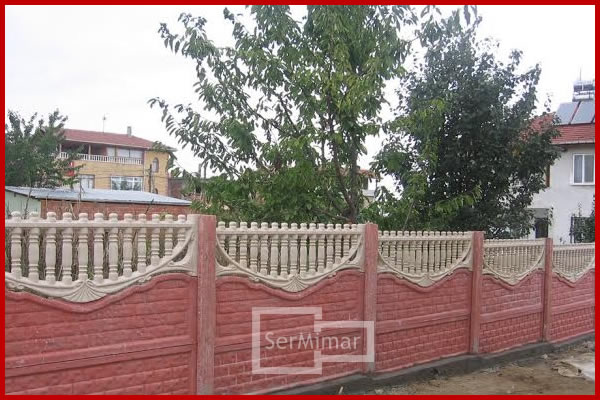

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar