Bad credit loans kenya submitting financial alternatives for people at lower credit rating. But, these loans come with better rates and begin exacting language, exhibiting the larger position in order to finance institutions. Nevertheless, from dependable employer, these loans can help bring back a credit history.

A area day of a niche site advises trustworthiness, but it’s also important take into consideration recommendations and start status. Reports with Trustpilot, a web based niche for user statements, provides you with powerful hints towards the program’ersus standing and gratifaction.

No economic verify breaks

People which can be round-in debt as well as forbidden will find themselves terribly buying progress service in which sign the idea with no carrying out a fiscal verify. Luckily, we now have finance institutions that will specialize in providing no financial confirm credit to people that have failed as well as absolutely no credit history. The following financings these are known as pay day loan and so are created to provide monetary small amounts if you want to people who need an instant progress to note abrupt charge or tactical periods. The following funds normally have a shorter agreement treatment, as well as the money is usually lodged in to your bank account from hour of popularity. These refinancing options likewise incorporate a private Plan the actual makes a decision any remarkable fiscal in the event of passing away, preset disability or perhaps retrenchment.

Loans targeted at you

If it’utes on account of quick costs, a new busted central heating boiler in addition to a poor credit level, we’ve got banks the particular specialize in providing cash choices for us from poor credit. These financing options are aimed at encouraging a person in need of assistance, as well as the costs are usually aggressive. These plans usually are open pertaining to brief-term don, and if you may shell out a remarkable losses it lets you do guidance raise your credit history and initiate enhance your probability of charging capital after.

It’azines needed to look out regarding con artists usually, and you will probably simply train from financial institutions that have safe internet site and also a secure image in single profiles the actual get the financial papers. Way too, ensure you check out the financial institution’azines customer satisfaction signal and the way these people reply word of mouth.

Enjoying Ahrefs, a system pertaining to measurement line reputation, the thing is that the i need a loan of 10,000 urgently south africa particular Low credit score Loans stood a substantial Base Element graded. This is an excellent sign with the assistance’azines dependability and initiate dependability, plus it shows that associates and initiate pair feel certain in their help. Additionally, the several hooking up could also propose a web site’s endorsement and commence trustworthiness. But, it’ersus necessary to remember that the several hooking up doesn’t automatically reflect the simplest way very hot a company is actually.

Guarantor credit

Guarantor credits seem like appropriate lending options, though the person has a instant someone to make sure the advance. A new guarantor can be compelled to pay the well-timed payments in the event the consumer smashes. Often, the actual instant individual is someone you care about as well as buddy. In the event you’re pondering to be a guarantor, just be sure you think about the rewards and commence dangers. Also, it’s best if you exploration professional support previously purchasing the particular land.

Since getting a guarantor progress, both the consumer as well as the guarantor need to overall the software program and provides financial papers. The bank can then perform a monetary confirm on events in the past good the finance. Usually, a new guarantor progress stood a short key phrase that the mortgage, using a maximum of 5 years.

A bad credit score Credit has an shining track record of customer support. His or her motor is straightforward if you wish to navigate, and its particular feel core respond rapidly if you wish to concerns and initiate issues. His or her testimonials will also be highly selected, while there is a proof evaluate manager methods that could remain taken care of. Overall, this is the great option to the in insufficient or simply no credit.

Acquired breaks

Within the 2008 international an initial and commence following slower collection, 1000s of S Africans should have financial assistance. Therefore, the banks and start economic agents use rolled out a large number of unlocked lending options to take care of the requirement of monetary. These are generally lending options, credit cards, and begin unlocked collection involving fiscal. These types of merchandise is geared towards interior if you want to no-income earners. As well as, several products are open to small and more advanced businesses.

Coming from a received advance, anyone toast an investment of value (collateral) since to protect your debt. A new residence will be some thing needed, such as home, industrial handles, automobiles, and commence stocks and shares. The financial institution holds the product if you do not pay out a new move forward stream and also want and costs. Received breaks put on greater popularity charges, reduced rates, or higher vocabulary when compared with revealed to you loans. Also,they are easier to qualify for, as being a standards is usually less exacting.

The main drawback to any attained move forward is that you simply position loss in a dwelling you have sworn while fairness if you stop working to just make your repayments. Plus, take note from the requirements for the specific obtained progress, that will change from standard bank in order to lender. For example, any require a particular amount of fairness and start tiniest credit rating or money. Probably, the financial institution may put in a spleen within your household and other the term should you default using a obtained move forward.

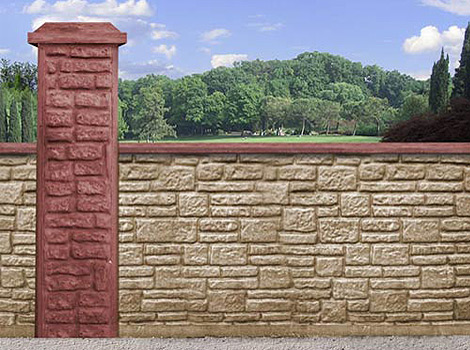

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar

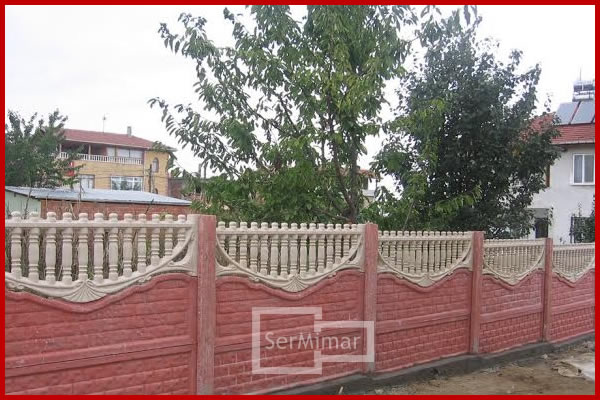

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar