Bonus Tax Calculator Pc

It’s also for anybody excited about understanding the tax therapy of supplemental revenue. This is essential as a result of tax rates can change, and the calculator will use the most current charges on your selected date. You can modify your W-4 form to guarantee that enough taxes are being withheld out of your regular paycheck, which can help offset withholding on your bonus. Consult a tax skilled to determine the optimal withholding changes in your situation.

Strategically shifting it to a different yr would possibly lower your tax bracket. In such cases, a federal tax fee of 37% is imposed on the amount over $1 million, reflecting the upper incomes bracket. These rules ensure that such income is appropriately taxed, typically at totally different charges than standard wages. Supplemental earnings encompasses varied forms of earnings outside common wages.

The combination technique can end result in the employer withholding too much or too little, depending on the W-4 you have on file. That stated, the IRS considers some benefits — which it phrases “de minimis fringe benefits” — to be too unrealistic to account for. These embrace occasional vacation gifts, snacks, occasion tickets, meal cash, transport cash whereas working extra time and flowers for special events. It’s important to educate yourself on how your bonus shall be taxed so that you save sufficient of the bonus for tax season. Remember, the deadline is quick approaching, so take a look at the Last Day Taxes web page to avoid Uncle Sam’s wrath (and a potential audit that’ll make your accountant weep).usa-bettingoffersfinder.com/

Careful consideration of each bonus taxation and potential credits just like the CTC is crucial for maximizing your after-tax earnings in 2025. Generally, bills incurred solely to earn a bonus usually are not deductible. However, this requires careful documentation and infrequently necessitates consulting with a tax professional to make sure compliance with related tax rules. If a person has capital losses of their funding portfolio, they’ll strategically promote these losing investments to offset the capital positive aspects generated by the bonus. This tax loss harvesting technique can cut back the taxable portion of the bonus. For instance, if a person has a $5,000 capital loss and a $10,000 capital acquire from the bonus, the net taxable acquire is decreased to $5,000.

This provide is best for Regions Bank prospects who’ve a checking account and need to start saving for their financial goals with a separate savings account. The Wells Fargo Everyday Checking Account promotion is greatest for people who receive direct deposits totaling at least $500 each month into their new account. We picked the Wells Fargo Everyday Checking account as a end result of it offers a generous bonus of $300 for a comparatively low direct deposit requirement of $1,000. It also comes with the convenience of a brick-and-mortar branch for all your in-person banking wants. All of the accounts on our list have low fees and some earn a excessive annual proportion yield (APY), making them a sensible choice to continue using long after you’ve acquired your bonus.

How these withholdings have an result on you personally is dependent upon your general bonus amount(s), W-4 data, and the tactic your employer uses to calculate withholdings. What you may not know is that the IRS considers bonus pay a type of earnings generally known as supplemental wages, which is topic to a separate tax withholding desk than your regular pay. This guide explains what bonuses are, how the bonus tax fee works, and the steps you’ll be able to take to help reduce the tax influence of this extra earnings.

This means that for any bonus you obtain, 22% will be deducted for federal taxes earlier than you receive your payment. This method is straightforward and ensures constant tax withholding, making it easier for both workers and employers to handle payroll. Bank bonuses typically carry direct deposit requirements, but what counts towards necessities can vary. Sometimes, merely enrolling in direct deposit is sufficient to qualify for a bonus. Other occasions, you have to additionally preserve a minimum stability or receive a minimal quantity in direct deposits in a set period of time. Direct deposits are often defined as electronic payments similar to paychecks, pensions from an employer and government benefit payments, together with Social Security.

That’s because your employer should withhold taxes out of your bonus — and people taxes can take a big chunk. Advisory services are offered for a charge by Empower Advisory Group, LLC (EAG). EAG is a registered funding adviser with the Securities and Exchange Commission (SEC) and an oblique subsidiary of Empower Annuity Insurance Company of America. Advisory charges are calculated based mostly upon the quantity of belongings being managed (as detailed additional within the Empower Advisory Group, LLC Form ADV). You can calculate your deductions utilizing each strategies to find out which possibility works in your specific situation. TwinSpires will credit bonus funds to customers as every $200 increment is handed, up to $400 inside the 30-day period for the promotion.

It’s useful to know how bonuses affect your overall tax picture, making certain smooth tax submitting. For excessive earners, bonuses exceeding $1 million are treated in a special way. The IRS stipulates that any portion of the bonus over $1 million is taxed at a fee of 37%. This data helps you anticipate potential tax liabilities when submitting your taxes and plan accordingly. Knowing these particulars lets you make knowledgeable financial selections. Several strategies exist for minimizing the tax impression of bonuses.

To earn the bonus, you must open a LifeGreen Savings account and arrange computerized monthly transfers from a qualifying Regions Bank checking account. Transfer a minimum of $10 per 30 days for a minimum of 10 out of 12 months and you’ll qualify for a 1% bonus, up to a maximum of $100. With some financial institution promotions, you have to deposit massive sums to qualify for the bonus. 3SoFi does not cost any account, service or upkeep charges for SoFi Checking and Savings. SoFi does charge a transaction fee to process every outgoing wire transfer.

It’s an easy approach but can appear high, particularly for smaller bonuses. Understanding how they are taxed can help you plan your finances higher. If you’ve any management over when you receive your bonus, consider the timing. If you expect a promotion or salary elevate, delaying your bonus could imply being taxed at a lower fee, particularly if it pushes you into the next tax bracket. Receiving a bonus is thrilling and often well-deserved, nevertheless it’s simple to get so caught up in the excitement that you just neglect in regards to the influence tax withholdings might have on your bonus. Understating how tax withholdings work and the way this might impact your bonus can help you put together.

In this methodology, the bonus is added to your most recent common paycheck. Your total income is then taxed based on the standard federal tax brackets. The methodology your employer uses to calculate the federal withholding on your bonus can have a huge impact on your take-home pay.

The following description particulars a chart illustrating the relationship between the bonus obtained and the ensuing web revenue after applying the model new tax charges. This visible aids in comprehending the monetary implications for individuals at varied bonus ranges. The yr 2025 brings important adjustments to the bonus tax rate construction, impacting how people are taxed on their year-end bonuses. These adjustments replicate a posh interaction of economic components and government policy aimed at balancing revenue generation with financial stimulus.

Federal Bonus Tax Rate For 2025

Knowing your 2025 Bonus Tax Rate is key to a stress-free tax season – except you enjoy the thrill of tax-related existential dread, of course. Another possibility is timing the receipt of a bonus, which might mitigate tax effects. This approach requires careful planning and consideration of future revenue. Bonus taxation can elevate many questions for employees and employers alike. Understanding the basics is essential to navigating the complexities concerned.

Finally, the constitutionality of the new tax price, notably in relation to ideas of equity and fairness, might be topic to authorized challenges. One efficient technique for decreasing your taxable income is to direct part of your bonus into retirement accounts like a 401(k) or an Individual Retirement Account (IRA). Contributions to those accounts can present benefits by method of retirement financial savings and general tax legal responsibility and scale back your overall tax bill. Using the combination method, your employer would multiply $16,000 by 12 months. This would cause the tax withholding on your bonus to be calculated as if you had been incomes $192,000 per year, bumping you up to the 32 percent tax bracket.

This consists of bonuses, additional time pay, commissions, and certain severance payments. The 2025 bonus tax rate’s competitiveness relative to other countries significantly influences [Country Name]’s attractiveness as a spot to work and do enterprise. A higher fee compared to comparable nations would possibly deter high-skilled employees and funding, while a lower fee might attract both but potentially cut back government income.

For example, a person incomes a bonus that pushes them into a higher federal tax bracket will see a higher portion of their bonus taxed on the greater fee. Federal revenue tax is a progressive tax system, that means higher earnings levels are taxed at greater charges. Bonuses are thought-about supplemental earnings and are added to an individual’s different earnings to discover out their taxable income for the yr. This total revenue is then placed within one of the federal revenue tax brackets, every with its corresponding tax rate. The larger the whole earnings, including the bonus, the upper the marginal tax fee utilized to the bonus. For instance, a bonus pushing a person into a higher tax bracket will result in a higher tax burden on that bonus than if it had remained in a lower bracket.

This is as a result of the bonus is considered earnings and is factored into the eligibility calculations. For occasion, a one-time bonus may quickly exceed the earnings threshold for meals stamps, leading to a temporary loss of advantages. Careful budgeting and financial planning can help mitigate these potential consequences. Bonuses obtained in 2025 shall be subject to state revenue taxes in most states, significantly impacting the online quantity an worker receives. The specific tax implications differ considerably depending on the employee’s state of residence and the state’s tax laws.

The data found on these web sites is authoritative and frequently updated to replicate modifications in tax legal guidelines. A significant bonus can impact the eligibility for sure tax deductions and credit. Careful planning is crucial to leverage out there deductions and credit successfully, even with a considerable bonus.

Employees ought to review their pay stubs to confirm that the proper withholding technique was used for their bonus. As a end result, this method offers clarity and predictability to both employers and employees. Whether you’re an employee receiving a bonus or an employer giving one, this guide will provide useful insights. Clarity on this subject can forestall potential pitfalls during tax season.

Do State Taxes Have An Effect On My Bonus?

Understanding the tax implications of bonuses in 2025 is crucial for monetary planning. Remember that your bonus income shall be subject to earnings tax, probably impacting your overall tax legal responsibility. This is especially related when contemplating other tax benefits, such because the Child Tax Credit Payment 2025 , which might offset some of your tax burden. Taxes On Bonuses 2025 – Understanding the tax implications of bonuses in 2025 is crucial for monetary planning.

data we publish, or the reviews that you simply see on this website. We don’t embrace the universe of companies or financial provides that might be obtainable to you. The content material contained in this weblog submit is meant for basic informational purposes solely and is not meant to represent authorized, tax, accounting or funding recommendation. You ought to seek the guidance of a qualified authorized or tax skilled concerning your particular scenario. No a half of this blog, nor the links contained therein is a solicitation or offer to sell securities.

Tax Implications Of Bonuses Are The Identical Throughout All States

Planning for a bonus may help you absolutely prepare for the tax implications. Check along with your employer to confirm how much they withhold, and ask for verification of that withholding, whether or not that’s on your paystub or in a separate document. These accounts are out there in many types, similar to a well being financial savings account, which you fund from pre-tax earnings to pay medical bills.

The banks listed on this web page at present have the most effective sign-up bonuses. This consists of SoFi, Bank of America, Alliant Credit Union and Wells Fargo. It’s in the end up to you to determine how many financial institution accounts will work greatest on your state of affairs. Bank referral presents do exist, but they’re uncommon compared to the widespread welcome bonuses for brand new customers. Deposit at least $100 per 30 days for 12 consecutive months to qualify for the bonus.

The particular tax brackets for 2025 might be decided closer to the year, however projections based on present developments can be used for illustrative purposes. Bonus income is subject to the identical federal and state revenue tax charges as your common salary, however it’s usually treated in a different way as a outcome of its lump-sum nature. This can result in confusion about withholding, tax brackets, and total tax legal responsibility. Understanding the nuances of bonus taxation is crucial for accurate tax preparation and avoiding sudden tax burdens. Bonus earnings substantially increases an individual’s overall tax liability for the 12 months.

How We Earn Cash

1/ST BET will problem bonus funds to users as each $100 increment is handed, up to $250, within the 60-day period for the promotion. 1/ST BET will credit score bonus funds inside three days of every $100 increment being reached. The 1/ST BET promo code provides users a $25 bonus for each $100 wagered, up to $250 complete. This is just like the promotion at TwinSpires, though customers have double the amount of time (60 days) to wager the $1,000 to get the full quantity in bonus funds. “It may be extra generously structured than the CTC as a end result of it’s a complement for a single, crucial yr, not an ongoing payment.”

- of companies or financial provides that may be available to you.

- Consumers Unified, LLC doesn’t take loan or mortgage purposes or make credit choices.

- If you count on a promotion or wage elevate, delaying your bonus could mean being taxed at a decrease rate, particularly if it pushes you into a better tax bracket.

- Additionally, staff ought to consider how their bonus affects their general monetary plan.

- A greater fee in comparability with similar nations would possibly deter high-skilled staff and investment, while a decrease rate may attract both but doubtlessly scale back authorities revenue.

Consumers Unified, LLC doesn’t take loan or mortgage applications or make credit score choices. Rather, we show charges from lenders that are licensed or in any other case authorized to work in Vermont. We forward your information to a lender you wish to contact so that they may contact you immediately.

This shift would possibly lead to the next tax rate on a portion of your earnings, affecting your total tax legal responsibility. On the opposite hand, the aggregate technique treats bonuses in a different way. It combines the bonus quantity with regular wages to determine the suitable withholding primarily based on the entire earnings. The 2025 bonus tax fee in [Country Name] necessitates a comparative analysis with related systems globally to know its place inside the worldwide panorama.

Keeping track of your cumulative annual earnings can help you anticipate any bracket adjustments. By planning, you’ll have the ability to strategize to mitigate potential tax impacts, like adjusting tax withholdings. The chart, a line graph, plots the connection between the gross bonus quantity (on the x-axis) and the net bonus earnings after tax (on the y-axis).

We are compensated in change for placement of sponsored services, or by you clicking on sure hyperlinks posted on our site. While we try to offer a variety of provides, Bankrate doesn’t embrace information about each financial or credit product or service. On the opposite hand, if too little cash was withheld out of your revenue throughout the year, you would wind up owing the IRS. You can cut back the danger of owing the IRS cash by reviewing your Form W-4, which tells your employer how a lot to withhold from your paychecks.

This will allow you to get a way of how much you’ll owe and whether or not you might have zeroed out your tax liability or shall be getting a refund. Bonuses can occur at any point of the year, and when they’re added to your wages, they inflate your earnings and might even push you to the next tax bracket. Whatever the rationale, the IRS considers a bonus a supplemental wage, a payment exterior the scope of an employee’s regular wages.

It can potentially scale back your total tax liability, resulting in savings. This method enables you to profit from compound development over time. You may also discover employer matches, which further improve your retirement savings. Adjustments to your withholding or proper planning can help you avoid surprises.

This part will analyze these variations and highlight key concerns for bonus recipients. For the mixture methodology, your employer lumps the bonus with the employee’s wages and withholds taxes as if the entire quantity is a single fee for a regular payroll interval. In this case, the withholding is dictated by the data in your W-4. This generally results in much less probability of you owing a appreciable amount of taxes or receiving a big refund if you do your taxes the following 12 months.

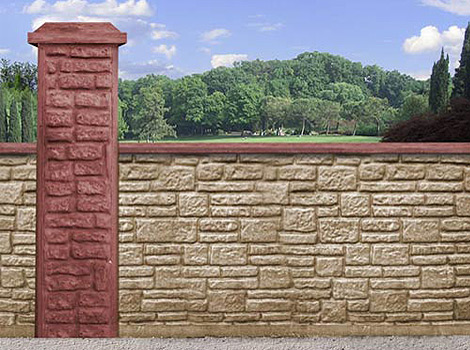

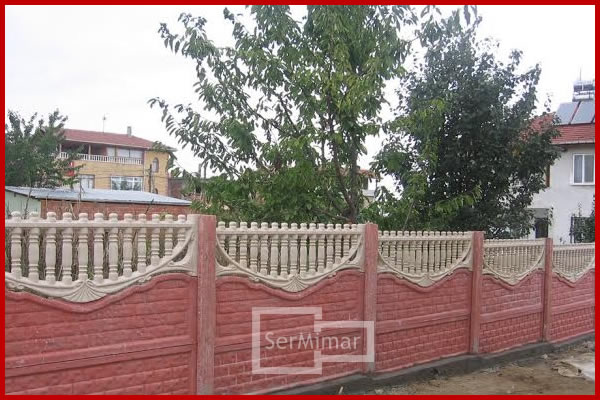

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar