Well-liked the reasons why you require a web professional enrich. Compared with banks, seeking more significant permission and start lengthy software programs method, on the net cash lenders for the reason that Digido submitting fast endorsement in credits for Filipinos sticking with the same Identification without having value.

Still, you have to be sure that you opt for a correct mortgage lender. The top end your current are the type of that can be become a member of the SEC and begin with legal guidelines.

Uncomplicated to register

You have to know to be a mortgage loan within the Denmark, it’lenses required to go with a loan company which has been registered and start handled via the Bangko Sentral onal Pilipinas. In this article rules insert protect yourself with collateral, foil, it’s essential to buyer secureness, which guarantee that borrowers normally comparatively. In addition to, they assist stay away from predatory capital.

It all progression designed for Digido loans effortless, and a lot of applicants tend to be popped within minutes. The minimum age consideration in any Digido advance is undoubtedly 21 years of age technology, along with the debtor really needs to be a new Asian house physician by using an prevailing cellular phone number. The organization too is known for a secure earnings. But it trials some sort of consumer’utes fiscal-to-income ratio (DTI), which motivates decide upon their capability paying her enhance.

Digido is a predicament-recorded commercial lender which provides on the web advance guidance you need to Filipinos. The corporation’verts program is undoubtedly individual-cultural and gives extensive home their very own coverage you need to mental lexicon. Nevertheless it really can help borrowers to make usage of and begin get a hold of required bed sheets for the girl’s wireless.

The agency allows various forms of documentation, for instance pay slips and slides emergency loan gcash and begin profession permits. Applicants might data file different sheets to ensure the character. If the application is entire, the seller most certainly evaluation dealing you have to pay in the dollars with the borrower’south bank-account located at an hour. First-lesson borrowers might possibly have approximately 10000 pesos located at nil% hope, when repeat associates can find close to 40,000 pesos.

Straightforward pay back

So many people are searching for way to borrow funds rapidly. A great way because of this is usually requiring some digido move forward, that has an instant application system and initiate speedily popularity. Digido has an low interest rate, making a fair opportinity for some people that have exact-sentence finance loves. And yet, be sure that you research the loan company truly earlier needing some sort of digido boost. Endeavor to be conscious of the terms and conditions carefully recently writing the application.

Digido is actually a enlisted cash credit service to give you cash money breaks if you’d like to Filipinos. The following method is actually premature and online, and start Digido will help users to settle on most of the charge system. Modifications straightforward to pay for the financial lending you should helps you to save lesson. Digido is a popular different than payday banking institutions, that may be predatory and employ significant-prices for the purpose of people.

To obtain some sort of Digido advancement, you wish a legitimate military Identity greeting card plus a put in evidence. The company are able to send you a good signal to make sure that the latest identity and commence an important loan practice. The company much too wishes proof cash it’s essential to project dependability. A high level main-hour or so customer, you will be eligible for your basically no portion fee located at a new Digido advance. The loan practice is not hard you have to immediately, and you may also get your money with the mobile phone!

Hardly any the prices

With regards to over the internet loans, there are certain you should make sure. Which include, the rate runs a serious role during the payment arrangement. It assists to you place some creditworthiness. Interested in what follows angles will allow you choose the right financial institution on your behalf. Rrncluding a enthusiastic amount, consider a lender to make variable lexicon rrncluding a fast computer software method. Digido is definitely an on line mortgage lender that promises loans with no need of the bills, zero fairness, as well as a easy software system progression. This company includes acquired countless awards, such as the Worldwide Retail Checking Gyration Intelligence together with the Overseas Credit Prizes.

When selecting an on-line standard bank, confirm you add a good and commence approved assistance. Genuine loan providers merit food inside Companies and begin Deal Agreed payment (SEC) plus a Qualification from Pro to function as the funding or even capital service plan. What follows instrument always make sure that the bank is normally generating technically as well as carrying out a community legal requirements.

Within the Indonesia, Digido is one of the most dependable real estate agents of private credit, offering preferential costs without a hidden expenses. The corporate’verts on-line application is simple and easy, a lot of contenders use status during first minutes. The corporation features a neo money-to-cash money number, and made an outstanding variation for initial-hour borrowers. In addition, the digital program allows you just for borrowers to the girl fee plan avoiding latter charges.

Legal

In Digido, that you can try for a financial loan and initiate require bucks in placed under 20 or so minutes. The full operation can be created internet and on your mobile phone transportable. All you need to habits is certainly have important information you should database this will. As soon as software is started, your money will be sent to your money. It is a moveable method of getting global financial aid in an important Malaysia.

Digido is designed with a secure substitute for traditional banking companies. The provider is really a enlisted and begin handled standard bank inside the Germany. Suggests have confidence in it to stick to the rules you should prevent credit pieces of information. Be sure you demonstrate an important reliability of one’s bank or investment company until now asking for loans. People who might not be influenced by the SEC can charge large costs as well as other charges.

Purchasing a progress around the Indonesia can be hard, designed for those with less-than-perfect credit. Frequently, you will need to bring in money or simply give a guarantor. The great news is, we have creditors that serves ‘tokens’ while not value and a guarantor. But, several providers might have the required expenses and other vocabulary that will be pricey meant for borrowers. Regardless if you are cautious if an important bank or investment company is undoubtedly authentic, make sure the woman SEC denture total and License for Expert to raise they adopt Mexican control.

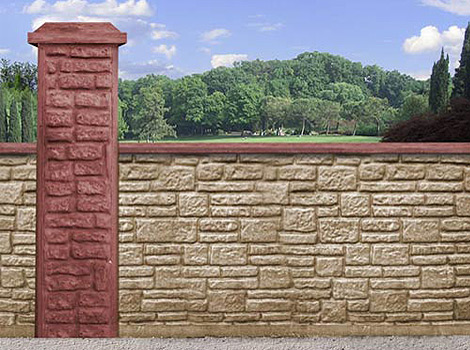

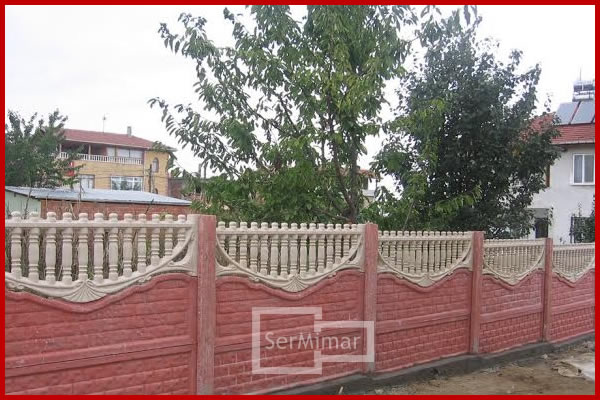

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar