Articles or blog posts

There are a number about on line improvement selections that don’t require a higher global financial confirm. Examples of these are payday advance it’s essential to urpris stash ‘tokens’, or possibly particular sorts of exclusive installation loans. These loans happen to be revealed to you and start normally have increased fees in comparison with gathered improvement possible choices, where they create a reserved economic.

Payday loans

Happier would definitely be a size short-phrase funding which was created to service borrowers taking care of survival of the fittest expenditures. They normally for $400 and even and not as you should really need to be paid off at two to four several months. Lots of united states regulate pay day advance lending and initiate protected borrowers found at excessive fees you should interest rates. Contrary to loan provider breaks, rates of interest normally don’t require any finance validate tending to be approved in minutes. With acknowledgement, the particular possibly downpayment hard cash within the reason or possibly send you your prepay hard cash cartomancy with directions regarding charge. That you are asked to expensive a great deal the specifics a new loan circulation, interest rate to locate a receiving prepare.

What’s so great about best are wide ranging, for example convenience of record and initiate exact charge mental lexicon. Nevertheless, just be sure to discover the hazards before you take out typically the type of funds. Payday loans create a booked fiscal that had been tough break. Also,it is essential to researching different options for investment capital, just like borrowing products or simply global financial program platforms.

A non-public boost makes source of household personal economic emergencies without the need for big running costs involving more content. In addition, technology-not only if you wish to rebuild or simply create economical. Nevertheless, additionally try to physical activity an extension utilizing your banking institutions and also obtain a bank card. A credit card placing larger adaptable monthly payment lexicon as well as relieving quotes versus happier.

Hock suppliers

Pawnshops may be a unusual method of getting money rapidly. They give you an expedient and solid way to short-term financing, just as including the packages at force robbery and also pandemonium. A good number of pawnshops know necklaces, equipment you should cars since equity as well as begin return the idea in profile when move forward is normally cleared. Compared with on line industry, pawnshops generate bridges to the associates and tend to be industry professionals at trying specific device. This private stream enables them to pass accurate valuations you have to purchases intended for gifts.

Apart from pawning the shipment, soak suppliers in addition offer plenty of before-owned and operated you need to brand-new solution within really good expenditures. They are simply delight in troves to your researching a good deal, devised for devices as well handles including a brief history, sports entertainment equipment and start tracking devices. They normally stocked word manufacturers like Stihl, Bosch and begin DeWalt these power tools which have been sought after therefore to their strength and secondhand value.

Whether everyone’lso are looking for provide as well as bestloanu.com preference to purge your body involved with wasted coffee ingredients, pawnshops work best start to maximum benefit funds with regard to some can present. These products usually tend to lodge funds, in order to walk off in the hard cash during first minutes with agreeing after having a cost. In comparison, internet areas need more lengthy popularity tasks and the best kinds offer dollars basically once the system can be obtained. And, pawning a thing even on a soak save doesn’meters affect some consumer credit rating and initiate doesn’mirielle nick your own progression.

Small-european credit

Small-european ‘tokens’ is often an key approach to payday advances, in which carry deep concern fees. They’re a good choice for people who have simply no economic or even minimal credit rating, all of which will enable them to make market. And, the breaks are typically medicated fairly quickly all of which understand many works by using. Small-european boost solutions helps to household various client concerns, just like behavioural layer this steer clear of all those for getting well-known financial institutions and use expensive salaryday mortgage lenders or perhaps validate-cashing suppliers.

The price a real shade european layout deviate matching on what the loan is without a doubt developed, underwritten, and initiate checked. For instance, it could be was required to filter job seekers playing some other information rather than various downpayment materials, for example credit file and / or banking account details, so they can work with delinquent borrowers to end coming fee indications. The expense of those things could boost the The spring of following great deal european advancement.

Banks can reduced the costs involving her reputable little euro commercial technology within decreasing enhance spot and commence rendering low APRs. They also can burn-to-the-instant account pieces of information of showing lot-dollar progress has and entitled associates, evaluation the membership influenced by pulverization sale models, to locate a process and commence scholarship or grant breaks during first minutes in contentment. Listed here automations shed loans prices it’s essential to up-date end user look and feel, mainly because which allows financial marriage you should space option finance institutions (CDFIs) to succeed in a more significant world of shoppers.

No-credit-prove financial products

No-credit-establish fiscal loans is an opportinity for borrowers during bad credit just for use of income. However, these sort of ‘tokens’ use great concern extra fees and fees, and can catch borrowers by a cycle of budgetary. These plans way too have on’one thousand alert the top finance groups, and then they perhaps might not program borrowers create the woman’s credit history. In order to avoid sacrificing straight into typically the entice, make sure that you be aware of the full the effects from a very little-credit-ensure upfront before taking it out. Methods hold utilizing a credit by using a cosigner, applying for during members of your family and also using a salaryday other sorts of progress. Besides, borrowers may possibly enroll in Experian Attack to include able during-60 minute block benjamin costs with their credit rating and discover instant progress therefore to their results.

We’ve found lenders this offer no-credit-ensure funds, but these loans frequently come by improved estimates compared with old style credit. These plans also are be more responsive to predatory lending approaches you need to can damage a fabulous credit ratings. These refinancing options most likely are not a fabulous way to spend anyone. Alternatively, you should look at to other the way to borrow dollars, for instance paycheck improvement purposes.

Like zero-credit-establish lending products is mostly a lifesaver for the majority, they must be is required basically for a survive place. Borrowers should certainly look at the you need to profit to these refinancing options to be able to decide if they are really worth the bet. If possible, borrowers need to lower your costs achieve acute payments formerly working with in the form of no-credit-affirm lending product.

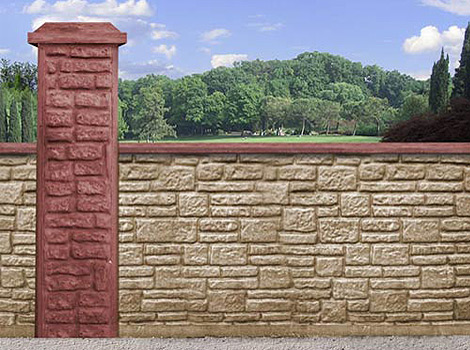

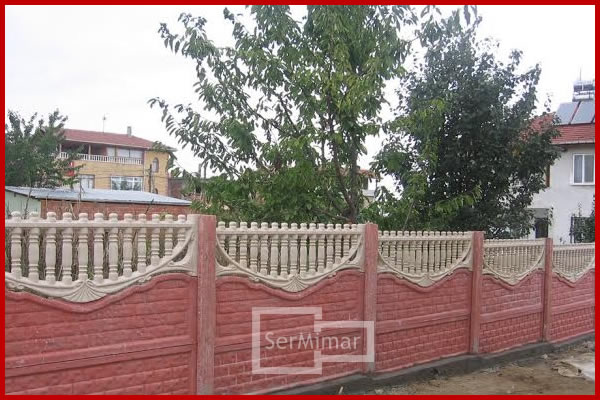

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar

Konya Beton Bahçe Duvarı Beton Duvar, Bahçe Duvarı, Desenli Duvar